In today’s digital age, social media is an integral part of daily life for many Austin residents. From sharing family moments on Facebook to posting workout selfies on Instagram, these platforms help us stay connected. However, if you’ve been involved in a car accident or personal injury claim in Austin, what seems like an innocent post could jeopardize your entire case. Insurance companies actively scour social media to find evidence that undermines your claims, often twisting harmless content to reduce or deny settlements. This practice has become increasingly common in Texas personal injury cases, where “social media car accident claim” disputes can lead to significant financial losses for victims.

At Joe Lopez Law, we’ve handled numerous Austin personal injury cases where insurance company social media investigations played a pivotal role. In this comprehensive guide, we’ll explore how these tactics work, share scenarios, and provide practical advice to protect your claim. Whether you’re dealing with a minor fender-bender or a serious injury, understanding social media risks is crucial for securing the compensation you deserve.

How Innocent Posts Can Destroy Austin Personal Injury Claims

Imagine recovering from a car accident on I-35, claiming severe back pain that prevents you from working. Then, an old photo from a family hike resurfaces on your feed, tagged by a friend. The insurance adjuster spots it and argues your injuries aren’t as bad as you say. This scenario isn’t hypothetical—it’s a reality for many Austin claimants. Social media posts can contradict your medical records, cast doubt on your credibility, and slash settlement offers by thousands of dollars.

Insurance companies view social media as a goldmine for “free surveillance.” They don’t need private investigators when claimants voluntarily share their lives online. There have been cases where Austin personal injury social media evidence reduced settlements by 30-50%, turning a potential $100,000 payout into far less.

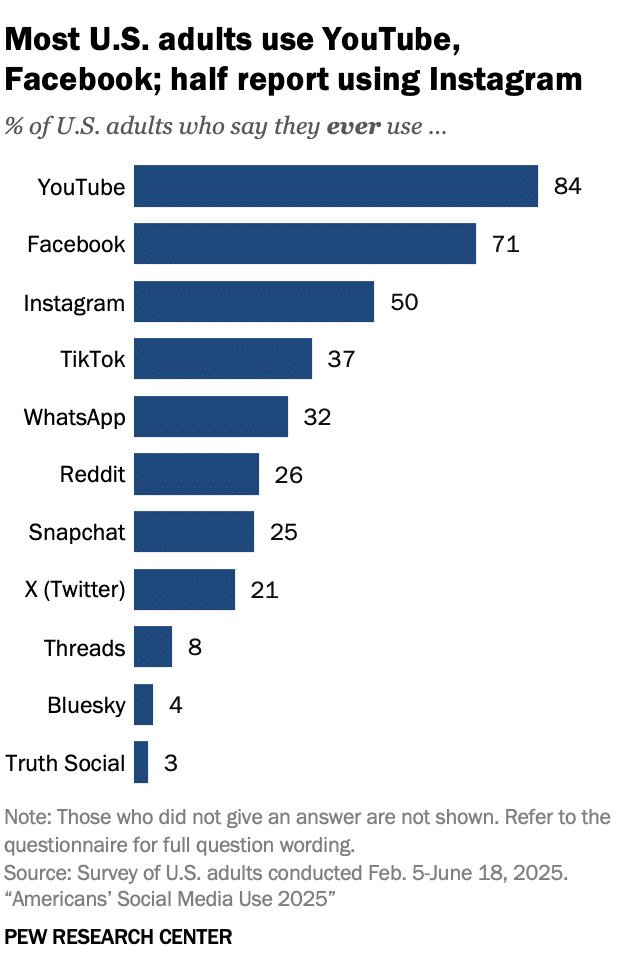

The problem stems from context—or lack thereof. A smiling photo doesn’t show the pain medication you took beforehand, and a “feeling great” status update might refer to emotional relief, not physical recovery. Yet, in the hands of a skilled defense attorney, these become weapons. As social media usage soars—with over 70% of adult Americans reporting use of social media platforms like Facebook and Instagram—the risks for those pursuing social media car accident claims have never been higher.

What Insurance Adjusters Actually Look For on Social Media

Insurance adjusters aren’t casually browsing; they’re conducting targeted investigations to minimize payouts. In car accident claims, they focus on inconsistencies between your stated injuries and online activity. Common red flags include:

- Physical Activities: Posts showing you lifting weights, running, or even carrying groceries that contradict claims of limited mobility.

- Emotional Statements: Updates like “Life is good!” that could undermine pain and suffering claims for anxiety or depression.

- Timelines and Locations: Check-ins or geotags placing you at events during alleged recovery periods.

- Connections and Comments: Interactions with witnesses or at-fault parties that might suggest shared fault.

- Pre-Existing Conditions: Old posts hinting at prior injuries they can link to your current claim.

Adjusters use specialized tools to scan public profiles across platforms. They verify account ownership and relevance, ensuring evidence is admissible in Texas courts. In Austin personal injury cases, we’ve seen adjusters pull metadata from photos to prove timestamps, turning a seemingly old image into damning proof.

One tactic involves cross-referencing posts with medical records. If you claim constant pain but post about a night out, they’ll argue exaggeration. Remember, Texas law allows social media as evidence if relevant, per the Texas Rules of Evidence. Adjusters also monitor friends and family—tags or comments can indirectly harm your case.

Example Scenarios: How Social Media Can Hurt Your Settlement

These realistic scenarios illustrate the devastating impact of social media on settlements in Texas personal injury cases:

Scenario 1: The Vacation Photo Debacle

Imagine an Austin driver suffers whiplash in a rear-end collision on Mopac Expressway and is claiming ongoing neck pain with medical treatment ongoing. They demand $50,000 in damages. During the claim process, the insurance company discovers Instagram photos from a family trip to South Padre Island — posted shortly after the accident — showing the claimant swimming and building sandcastles. The adjuster argues these images directly contradict the claimed severity of the injury and the need for continued physical therapy. Result: Settlement offer drops dramatically, potentially to around $15,000.

Scenario 2: The Check-In Catastrophe

Consider a pedestrian struck by a distracted driver in downtown Austin who claims serious leg injuries that prevent them from returning to work. While the claim is active, adjusters find a Facebook check-in from the claimant at a UT football game, complete with stadium selfies showing them standing and walking without visible assistance. The insurance team uses this to argue the injury is not as debilitating as claimed. Result: A strong $75,000 demand is significantly reduced — possibly to $25,000 or less — after the claimant’s credibility is challenged.

Scenario 3: The Activity Contradiction

Picture someone who slipped and fell at an Austin grocery store, claiming severe, ongoing back pain that limits daily activities. During the claim investigation, the insurance company uncovers recent TikTok videos of the claimant dancing energetically at a local music festival. The defense uses these videos to question the severity of the reported pain and functional limitations. Result: The claim faces major resistance, with the insurance company potentially denying or severely undervaluing the case.

These examples highlight how photos, check-ins, and activities become ammunition in social media car accident claims. In Texas, courts allow such evidence in an increasing amount of contested personal injury trials involving digital proof.

Posts That Seem Harmless But Aren’t

Many Austin residents underestimate subtle posts that sabotage claims. Here’s why these “innocent” updates can backfire:

- Gym Photos: A selfie at the gym might celebrate a small milestone in physical therapy, but adjusters see it as proof you’re not injured. Documentation of a “light workout” could significantly lower your settlement amount.

- Vacation Pics: Even if pre-injury, untagged or misdated images can confuse timelines. Posts from a weekend getaway to Lake Travis could be used to argue exaggerated emotional distress.

- “Feeling Better” Updates: A casual “Finally turning a corner!” on LinkedIn could imply full recovery, undermining future medical expense claims. Adjusters interpret optimism as evidence against ongoing suffering.

Other pitfalls include event RSVPs, pet-walking videos, or even recipe shares implying physical capability. In Austin personal injury social media disputes, context rarely saves you—adjusters present posts in the worst light.

Platform-Specific Risks (Facebook, Instagram, TikTok, LinkedIn)

Each platform poses unique threats in insurance company social media scrutiny:

- Facebook: Long-form posts and event check-ins are gold for timelines. Tags from friends expose private moments. The risk here is high for older users sharing recovery updates.

- Instagram: Visual-heavy with stories and reels. Filters hide pain, but metadata reveals dates. In Texas cases, vacation stories have contradicted injury claims.

- TikTok: Short videos show movement. Dance challenges or daily vlogs can demonstrate agility, harming mobility claims. Austin’s young demographic faces amplified risks here.

- LinkedIn: Professional updates like “Back in the office!” imply work capability, countering lost wage claims. Endorsements for skills involving physical tasks add fuel.

Cross-platform sharing amplifies dangers— a TikTok reposted to Instagram doubles exposure.

Privacy Settings Myths: Why “Private” Doesn’t Mean Protected

Many believe setting accounts to “private” shields them from scrutiny. This is a myth. In Texas, courts can subpoena private content if relevant. Adjusters access public info legally, and “friending” under false pretenses is rare but possible via ethical boundaries.

Private settings don’t prevent friends from screenshotting or sharing. Metadata remains discoverable, and platforms like Facebook store data indefinitely. We’ve seen “private” posts admitted as evidence after subpoenas, per precedents like Romano v. Steelcase. True protection? Limit activity, not just visibility.

What You CAN and CANNOT Post During an Active Claim

To safeguard your claim:

- CAN Post: Neutral content like news shares, pet photos (without you), or inspirational quotes unrelated to health. Keep it vague and infrequent.

- CANNOT Post: Accident details, injury updates, medical visits, legal discussions, physical activities, or emotional states. Avoid apologies or fault admissions.

Best practice: Pause posting entirely. If you must, disable tagging and location services.

How to Protect Yourself Without Going Dark

You don’t need to delete accounts—here’s how:

- Adjust privacy to max: Friends-only visibility.

- Untag yourself from posts.

- Inform family: No mentions of you.

- Use apps to monitor activity.

- Consult your lawyer before posting.

Stay connected via private messages or calls. You can still communicate without risking your Austin personal injury claim.

What to Do If You’ve Already Posted Something Problematic

Don’t panic or delete— that could be seen as spoliation of evidence. Instead:

- Tell your attorney immediately for context strategy.

- Stop all future posts.

- Archive (don’t delete) questionable content.

- Gather explanations: Dates, contexts.

Honest disclosure can allow us to rebut twisted evidence, which can help save the claim.

Protect Your Austin Personal Injury Claim – Get Your Free Case Review Today

If insurance company social media tactics have complicated your social media car accident claim, don’t face it alone. At Joe Lopez Law in Austin, we specialize in countering these strategies to maximize your compensation.

Contact us today for a free, no-obligation case review. Let our experienced team protect your rights and fight for the settlement you deserve. Call (512) 580-9962 or fill out our online form to schedule your consultation. Your recovery starts here.